We are a Banking Group specialising in financing solutions for companies in performing or re-performing situations. More than a century of history behind us (we were founded in 1898) has taught us that in the world of corporate finance, 4 values count:

These values are the foundations of Credito Fondiario, a technologically advanced bank that offers specialised financing solutions to support the economic fabric of the entire country. Some call them challenger banks, fintech, neo-banks. Others speak of specialty finance. At Credito Fondiario, we aim to make these slogans real by offering Italian businesses:

Competent, tailor-made response to structural and liquidity financing needs.

An offer that includes factoring services, purchase of tax credits, real estate financing, structured finance transactions and short-term secured financing.

A technologically evolved model of bank-business interaction that ensures efficiency and rapidity in the response and disbursement of financing.

Credito Fondiario aims to become the most innovative and evolved bank for Italian companies, more capable of meeting the needs of its customers.

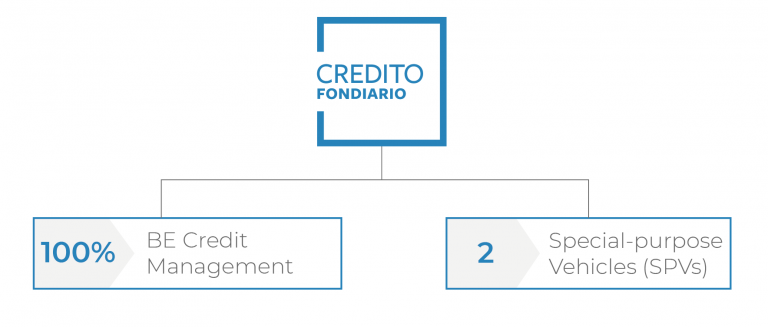

Credito Fondiario Group, registered in the Register of Banking Groups, is made up of the parent company Credito Fondiario S.p.A., of the subsidiary company Be Credit Management S.p.A. (born from the strategic partnership with Be Finance S.r.l., a company specialised in tax credits) and of two special-purpose vehicles (SPVs) as per Law No. 130/99.

SOLIDITY

A solid bank is a safe bank. The Group has a solid capital position and a robust liquidity profile in line with the characteristics that have always characterised our corporate history. CET1 (Common Equity Tier1) is well above requirements and among the highest in the industry in Italy. The NSFR (Net Stable Funding Ratio) and LCR (Liquidity Coverage Ratio), indicators that measure a bank’s ability to meet its funding needs as well as the availability of adequate liquidity reserves over a time horizon of one year and thirty days respectively, both in normal and highly stressed conditions, are well above the regulatory minimum of 100%. These are key elements in the realisation of the Group’s strategy as a challenger / fintech bank dedicated to Italian medium-sized enterprises operating through advanced operating and distribution models. The Group’s ample free assets and robust and diversified liquidity profile are able to support the investments envisaged in the strategic plan currently being implemented.

We want to create concrete value for companies by responding to their need for liquidity in a rapid and flexible manner, always offering the most appropriate and effective financing solution. We want to support companies in the development of their full growth potential or in the path of recovery and relaunch with professionalism and competence, to the benefit of the economic fabric of the country. We want to innovate the bank-business relationship to make it more efficient, transparent and rapid.

The orientation towards technological innovation has been a decisive growth driver for our Group and remains a fundamental and distinctive feature of our reality. Being 100% Cloud has allowed us to achieve remarkable technological performance in terms of security, business continuity, scalability and flexibility. Process and product innovation is the basis of our work. Thanks to the adoption of cutting-edge information systems and technologies for the digitalisation and automation of processes, we are able to process and analyse large quantities of data very quickly and speed up the entire credit application and disbursement process. An innovative model of interaction with the Bank allows us to guarantee businesses flexible financing solutions, focused on the specific credit needs of our clients.

Professionalism is one of the values we have built our history on. Our exclusive objective is to provide our customers with a certain reference point, a concrete response to their need for liquidity. We pursue this goal by placing their needs at the centre of our activity, which we carry out with transparency and integrity, always guaranteeing maximum confidentiality of information. For us, working with professionalism means providing companies with an attentive and highly qualified team to guarantee excellent service standards.

We help companies to express their growth potential or to embark on a path of recovery and relaunch, working alongside professionals who have in-depth knowledge of financing instruments and company dynamics, capable of analysing their needs and responding quickly and purposefully with customised credit solutions.

Our business model aims to offer the best financing solution in the shortest possible time. The adoption of advanced technologies for the digitalisation and automation of processes allows us to speed up the preliminary investigation process and ensure a rapid disbursement of the financing.

We were established in 1898 together with

the first Italian companies under the name Credito Fondiario Sardo,

specialising in the provision of mortgages in Sardinia and Rome.

In the post-war period, we extended our operations to almost the whole of Italy,

expanding our activities to include public works and industrial land financing.

In 1960, we entered the world of IRI

– Institute for Industrial Reconstruction (Istituto per la Ricostruzione Industriale) –

taking the name Credito Fondiario in 1965.

Credito Fondiario entered the financial market in 1985,

when the Bank’s shares were listed on the Milan Stock Exchange.

In the 1990s, our operations were extended to

medium- to long-term industrial financing,

consolidating our special aptitude for corporate credit.

In the 2000s, the Bank

changed its mission and specialised

in securitisation servicing

In 2013, Credito Fondiario is acquired

by Tages Holding and a group of entrepreneurs with the aim of creating

the first Italian new generation debt servicer / debt purchaser.

The strategic repositioning of Credito Fondiario

is further strengthened in 2016 with the entry of the new shareholder Tiber Investment S.a.r.l.

– a subsidiary of the Elliott Management Corporation Group – one of the largest investment companies in the world.

In October 2018, Elliot becomes the Bank’s majority shareholder.

With a long-term vision, it supports the growth of Credito Fondiario by injecting capital and promoting

the managerial strengthening of the structure with the aim of making it a market leader.

In these years, Credito Fondiario has become a reference operator,

growing in size, gaining a very strong competitive position, working as a partner alongside

banks and institutional investors, continuously maintaining levels of capitalisation and financial solidity among the highest in the sector.

Product and process innovation plays a key role in this growth path. Investments in technology

and innovation are substantial and account for 25% of total costs. Thanks to integrated IT systems

and re-engineered management processes, Credito Fondiario has carried out a process of review

and innovation of every single phase in which a bank sells its impaired loans, establishing

itself as one of the most important operators in Italy in the credit sector.

In 2021, Credito Fondiario evolves its mission, moving closer to its origins as a bank for businesses, positioning itself as an innovative player specialised in business credit. Developing the full potential of all the skills and experience acquired over the years, it builds a diversified offer to meet the liquidity needs of companies that require support to deal with their development, consolidation or relaunch plans. The specialised and innovative offer is accompanied by an advanced technological platform, capable of moulding the bank-business relationship on the basis of efficiency and speed, especially as regards response times and credit disbursement. This strategic repositioning represents the natural evolution of a bank that has always been characterised by a great ability to renew itself in order to meet the needs of the market. The strong technological vocation and levels of capitalisation and financial solidity among the highest in the sector remain an important constant.

Co-founder of Tages. 35 years of experience in the financial services sector in Europe.

More than 20 years of experience in corporate and retail banking and strategic consulting.

Over 20 years of experience in investment banking and financial services.